ASX Announcement

Wellard Ltd (Wellard, ASX:WLD) advises that it retained positive EBITDA and cashflow for FY2019, however poor trading conditions in the second half of the financial year (H2 FY2019), vessel

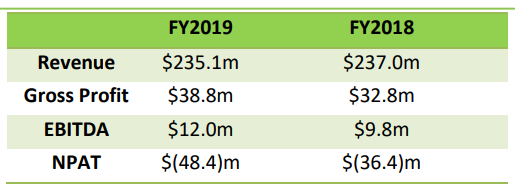

impairments and financing costs contributed to a net loss after tax of $48.4 million (FY2018: $36.4 million).

Improved EBITDA of $12.0 million (FY2018: $9.8 million), operating cashflow before interest of $29.8 million (FY2018: $7.7 million) and a $33.9 million reduction in net debt – which will reduce further post June 30 with the sale of the MV Ocean Swagman – were the highlights of a financial year that started off with significant promise but was curtailed in the second half with limited chartering of the Company’s two larger vessels due to the closure of Turkey live cattle imports for almost all of H2 FY2019.

A $22.4 million impairment created by the sale of the MV Ocean Swagman, the reduction in carrying values of another vessel in the fleet and the sale of the Wellao feedlot development had a significant impact on the $48.4 million reported loss.

Wellard Executive Chairman John Klepec said, “Vessel utilisation fell, with the MV Ocean Shearer spending the second half of FY2019 without a charter and the MV Ocean Drover also significantly underutilised during that period.”

“Both are now chartered through to early November 2019, so are back generating revenue again.”

“We continue to work hard on restructuring Wellard’s balance sheet as these results are further evidence that our earnings volatility cannot support the Company’s existing debt levels, particularly

when there are major trade interruptions.”

“The post balance sheet sale of the MV Ocean Swagman, with associated future reduction in liabilities to shipping financiers and noteholders will be of considerable help in this area.”

Wellard’s $235.1 million revenue for FY2019 was similar to FY2018, and gross profit improved 18.3% from $32.8 million (FY2018) to $38.8 million (FY2019).

Wellard was able to strip another $2.2 million from its operational and administration expenses ($24.6 million in FY2019 v $26.8 million in FY2018), but an increase in financing costs to $11.2 million and impairment expenses to $22.4 million impacted on its profit result.

Balance sheet

Wellard completed a number of asset sales in FY2019 as part of its balance sheet repair task.

This included the Company’s Beaufort River Meats abattoir, Wellard Feeds feed mill and La Bergerie Pre-Export Quarantine business.

This contributed to the reduction in total liabilities from $194.3 million to $142.5 million, with only a marginal reduction in earnings contribution.

In addition, agreements have been signed for the sale and leaseback of the MV Ocean Swagman for US$22million in a FY2020 transaction.

Despite the improvement in a number of areas, Wellard was in breach of banking covenants at 30 June 2019. As a consequence, all of Wellard’s long-term debt was required to be classified as being current. As in prior years, the Company is in discussions with respect to waivers of covenant breaches on its debt facilities. Wellard is working closely with its financiers and to date has

maintained a good relationship while engaging with them to obtain the necessary waivers.

Strategy and Outlook

The current outlook has improved on what was a very challenging H2 FY2019 but does not have the same level of certainty as this time last year, when Wellard released its FY2018 financial results and was looking out to H1 FY2019.

All vessels are currently on charter, positively impacting utilisation rates, however those charters are short term. Until the Company’s balance sheet restructure is completed, Wellard will exclusively focus on the chartering of its ships.

Wellard is confident those charters will be repeated due to a resuming cattle trade between South America and Turkey, recommencement of the Australian live sheep trade to the Middle East, and continued strength in the live cattle trade from Australia to Indonesia and Vietnam – all of which will provide chartering opportunities for Wellard vessels.

Mr Klepec said the superior performance of Wellard’s vessels had contributed to the finalisation of recent chartering agreements.

“Feedback from importers and exporters is that they know they will achieve superior weight gains and voyage success rates on our vessels. This places Wellard in a good position to capitalise on future charter opportunities,” he said.

“The live cattle trade between South America and Turkey is resuming and this is creating demand for shipping capacity. Volumes of cattle shipped from Townsville and Darwin to Indonesia are 30% higher than year ago levels and volumes to Vietnam are 16% higher.”

In January 2020, the Australian Maritime Safety Authority (AMSA) will ban the use of double tiered vessels on voyages commencing from Australia, a decision based on animal welfare grounds. It also removes grandfathering provisions on ventilation. Wellard’s vessels are unaffected by the new AMSA regulations, however it is considered likely that three large competitor vessels will be unable to meet the new requirements so will be prohibited from transporting sheep and cattle from Australia.

Also, in January 2020, a new International Maritime Organisation (IMO) regulation will reduce the cap on sulphur content in marine fuels from 3.5% to 0.5%.

Marine fuel oil is the second largest operational cost in the livestock export industry, behind livestock procurement. Low sulphur fuel oil is now and is expected to remain more expensive than the high sulphur fuel oil currently in use.

The fuel consumption of Wellard’s vessels measured on the basis of tonnes of fuel consumed per square metre of pen space per nautical mile is at the efficient end of the cost curve.

“Put simply, our vessels can carry more livestock in a quicker time period for a particular voyage while consuming less fuel than competitor vessels,” Mr Klepec said. “This is expected to either

reduce our operating costs compared to our competitors or foster additional charter demand for our vessels.”

For further information:

Investors

Executive Chairman, John Klepec

Phone: + 61 8 9432 2800

Media

FTI Consulting, Cameron Morse

Phone: + 61 8 9321 8533

Mobile: +61 (0) 433 886 871