ASX Announcement

Wellard Ltd (Wellard, ASX:WLD) advises that it recorded Earnings Before Interest Tax Depreciation and Amortisation (EBITDA) of $10.8 million and a net loss after tax of $2.1 million in the six months to 31 December 2019, as the Company continued to restructure its operations and balance sheet.

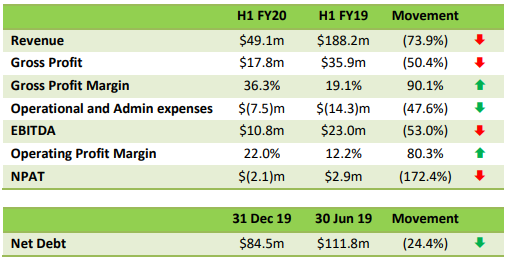

Revenue declined from $188.2m to $49.1m reflecting the Company’s shift to chartering activity, which increased from 18.1% to 93.2% of total revenue, as livestock trading activity declined from 81.9% to 6.8% of total revenue.

Importantly, Wellard’s gross profit margin increased by 90.1% with the transition from exporter/trader to charter business. Although EBITDA fell by 53.0% to $10.8 million, the 80.3% increase in the operating profit margin to 22.0% (2018: 12.2%) indicates that a significantly greater portion of revenue is now translating into operating income.

Wellard’s ‘Cost out’ program delivered savings for $6.8 million with operational expenses reduced to $4.1 million (PCP: $10.4 million) and administration expenses reduced to $3.4 million (PCP: $3.9 million), largely due to savings on labour expenses.

Wellard Executive Chairman John Klepec said Wellard’s EBITDA of $10.8m was a significant improvement on the negative EBITDA of $11.0m for 2H FY19 and was due to improved utilisation of

its largest vessels, though the MV Ocean Shearer did not complete a voyage in July or August, which weighed on the Company’s results.

“Importantly, the back to back chartering of all of Wellard’s vessels throughout Q2 looks likely to continue in Q3, albeit with the MV Ocean Swagman undertaking its periodical dry dock for about six weeks, providing the Company with a good operational and financial start to the second half of the financial year,” Mr Klepec said.

“The US$53.0m sale of the MV Ocean Shearer, scheduled to close before the end of March 2020, will complete our balance sheet restructure and, combined with the earlier sale of the MV Ocean Swagman, will see our monthly interest payments reduce from US$0.5m in July 2019 to an expected US$0.1m from April 2020.

“This will provide an improved translation of earnings to profit in the future.”

Balance sheet

Wellard continued with asset sales in H1 FY20 as part of its balance sheet repair task, finalising the sale and leaseback of the MV Ocean Swagman and negotiating the March 2020 sale of the MV Ocean Shearer for US$53.0 million.

Net debt was reduced by $27.3 million or 24.4% to $84.5 million (30 June 2019: $111.8 million). At 31 December 2019 total ship debt represented 57.9% of the book value of the Group’s shipping assets.

Contributing to the change in net debt, a total of $15.4 million (or US$10.8 million) of notes were redeemed in cash during the first six months of FY20. An additional $0.6 million (or US$0.4 million) of notes were also redeemed at the date of this announcement. The residual amount of US$4.3 million will be repaid to the noteholders in the next two months with the last instalment due by the end of April 2020.

Net assets changed little, shifting from $57.8m in the PCP to $55.8m at the end of the half. The funds to be received from the sale of the MV Ocean Shearer will enable the discharge and retirement of the vessel finance debt owed to Intesa Sanpaolo bank (“Intesa”). Following the full payout of the Company’s noteholders and Intesa, Wellard anticipates being in full compliance with the covenants on all remaining financing arrangements.

As with previous reporting periods the ongoing breach of covenants with the above financiers at 31 December 2019 resulted in the reclassification of $14.6 million of debt from non-current to current.

It is important to note that the Group made all payments due under its working capital facility and ship financing facilities during the reporting period, and reached a standstill and revised repayment agreement with noteholders which has been fully complied with. Despite the breach of financial covenants, the Group continues to maintain a good working relationship with all financiers.

Outlook

The current outlook for Q3 FY2020 is very good with all available tonnage chartered, in comparison with the poor ship utilisation rates in Q3 of the previous two years.

There is less clarity with respect to Q4 FY2020. Although recent rains across the top end of Australia are certainly welcome, and will assist in the long term with greater numbers of cattle being bred and therefore sold, any further increases in cattle prices for our exporter customers will place considerable pressure on exporter margins and therefore their ability to win new orders and charter vessels to Indonesia and Vietnam.

The key South America to Turkey trade remains uncertain. If Turkey starts to release more import permits as expected in the quarter, the MV Ocean Drover could be deployed to that trade.

The decision in November 2019 by then Agriculture Minister Bridget McKenzie to grant exemptions to double-tiered vessels from improved livestock vessel regulations was a retrograde step. Should such exemptions continue to be granted, the improved demand for the MV Ocean Drover from sheep exporters to the Middle East that was previously expected will be unlikely to occur in the short term. Chinese demand for dairy and breeding cattle remains strong and we will continue to charter our vessels to service that market.

Although the Novel Coronavirus (now renamed COVID19) is beginning to have a significant impact on international trade, and in particular the movement of goods and people into and out of China, there has been no impact on bookings of Wellard vessels to date. The situation does however, remain fluid, and Wellard is unable to predict the full impact, if any, on its business, or the business of its charter customers. The Company has several customers who have regularly booked Wellard ships that have continued to deliver Australian breeding cattle to various Chinese ports.

Animal welfare

No reportable mortality voyages or Exporter Supply Chain Assurance System (ESCAS) breaches (from previously exported cattle) were recorded by Wellard during the current reporting period.

Under our charter-only business model, Wellard continues to ensure that every animal in our care is managed to the highest animal welfare standards. Given our larger than average, purpose-built

vessels, our expert crew, and our rigorous emphasis on high standards of care, we continue to demonstrate that we can provide superior conditions for the transport of livestock to destination markets.

Wellard continues to support sensible and sustainable Australian regulations which move the industry away from mortality as the sole indicator of onboard animal welfare to alternative indicators.

Mortality does remain an important animal welfare indicator and of the 222,068 head of cattle transported during the period, our vessels recorded a mortality rate of 0.12% or 257 head.

This ASX release was approved by the Wellard Board of Directors.

For further information:

Investors

Executive Chairman, John Klepec

Phone: + 61 8 9432 2800

Media

FTI Consulting, Cameron Morse

Phone: + 61 8 9231 8533

Mobile: +61 (0) 433 886 871